Why InterPayments?

InterPayments Makes Surcharging As Easy As...

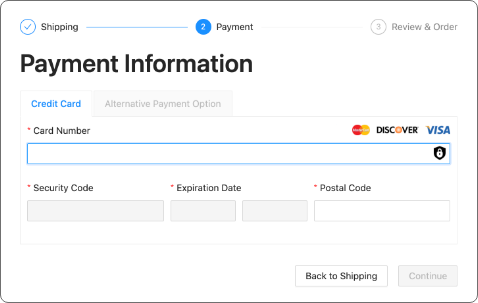

Credit card number and zip code entered on payment page.

InterPayments instantly calculates the exact, compliant surcharge amount for each specific credit card.

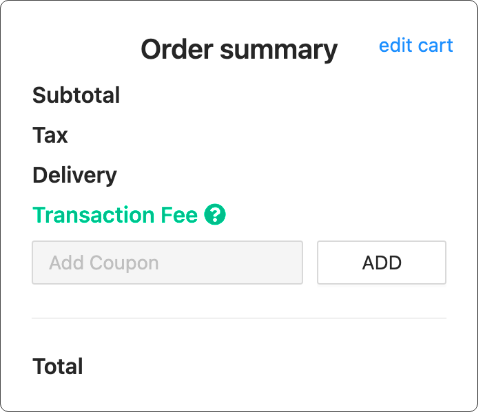

The amount is presented transparently to the customer as a Transaction Fee*

*We help you further lower costs by ensuring your customer can switch to an alternative payment method that's cheaper for you.

100% Control Over When,

Where, and How You Surcharge

Tailor surcharging for your business. There's no one-size-fits-all surcharging. Meet your customer needs and your business requirements.

Standard

Surcharging

Pass along the full cost of credit card processing.

Order-Based

Surcharging

Select which orders you want to surcharge and which you don’t.

Discount transaction

fee by %

Discount the maximum allowable surcharge amount applied to surchargeable transactions.

Set surcharge amount

by order value

Vary or eliminate the surcharge amount by order value.

Static Max

Surcharge Amount

Limit the surcharge amount to a fixed cents or dollar amount.

Static Max

Surcharge %

Limit the surcharge amount to a fixed percentage of the order value.

Surcharge On Your Existing Processing Terms and Platform

No rip and replace of your existing processing terms, processor, gateway, or payment platform. InterPayments allows you to compliantly surcharge on your current platform - or the one you’ll have in the future.

Processing Terms

Interchange Plus

Fixed Rate or Tiered Pricing

Platforms

If you’re on Interchange Plus, you and your customers benefit from lower processing fees overall. InterPayments ensures you retain that benefit. This is especially important if you intend to surcharge only a portion of your credit card volume.

If you’re on Fixed Rate or Tiered pricing, we’ve got you covered. As your business grows, you’ll likely move to Interchange Plus processing. We’ll be here to grow with you.

Put InterPayments

to the Test

Not sure if surcharging is right for all your orders? Our flexible solution allows you to test InterPayments on select products or offerings before committing to reducing credit card fees across all lines of business.

Check out our Customer Success Story to learn how testing InterPayments led one B2C merchant to roll our solution out across all their sales channels.

Read the Success StoryAutomated Compliance

67 jurisdictions - from state, federal, and industry regulations - create an evolving and complicated web of compliance hurdles.

Identifying Approved Cards

InterPayments' technology automatically differentiates between all card types – credit, debit, and prepaid - to maintain compliance.

30 day Card Brand Notification

InterPayments will notify all relevant stakeholders (card brands and acquirers that require notice) on your behalf.

Calculate Exact Surcharge Rates

InterPayments dynamically calculates the exact surcharge amount for each and every card. We maximize recovery and guarantee compliance.

Customer Surcharge Awareness

InterPayments creates a tailored customer surcharge notification process for you. You comply with state and card brand notice requirements while ensuring the smoothest customer payment experience.

Evolving State Legislation

InterPayments diligently oversees evolving and independent state regulations so merchants with a multi-state, omnichannel presence remain compliant.

Card Brand Rules

InterPayments' continuously updates our technology with card brands' complicated rules so merchants can maximize their margins with peace of mind.

Competitive Differentiation

Compliance Coverage

Integration

Tailored Surcharging

Payment Vendor

Required Processing Rate Model

Business Model

Geography

Data/Analytics

Support

Guaranteed

Anywhere you accept credit cards - any ERP, Virtual Terminal, CRM, Shopping Cart

Fully tailored to your business, at a click of a button

Any payment vendor you choose, now or in the future

No restrictions: interchange plus, tiered, and fixed rate (keep your low debit card rates)

100% aligned with your outcomes - technology fees paid based upon how much you recover

All 50 U.S. states + (future) select international markets (Canada, UK, Europe, and Australia)

Real-time transaction logs and savings data/analytics consolidated across all payment vendors and payment channels

Compliance guarantee means dedicated pre- and post-sales surcharging support; no additional professional services fees

Competition

None

Limited set of proprietary point of sale terminals and virtual terminals

None; must surcharge all or none of your credit card transactions

Only theirs

Restricted to 3.5% or 4% fixed processing terms (with much higher debit card rates)

Makes money by forcing you to their high 3.5-4% flat rate processing terms

Certain U.S. states only

Embedded in processing terms, not consolidated across all payment channels

No compliance guarantee, limited direct surcharging support